Drawing from his particular experience with technology and IP rich businesses, Shawn also advises technology companies from incubation through M&A exits, initial public offerings and other growth opportunities. He is also a recognised leader in late stage venture transactions and in early stage private equity transactions in Europe and the emerging markets. These complement his practice serving public and private companies in UK multi-jurisdictional and complex corporate transactions, including countless acquisitions and disposals, cross-border mergers, bankruptcy infused asset sales, recapitalisations and reorganisations.

Shawn leads Orrick's London Corporate practice, its Global Emerging Markets practice and co-leads the Global Fintech team. In addition to sheer volume of deals, Shawn's incomparable market insight stems from his leadership roles at Orrick, the only global firm focused on technology, and his experience working throughout the UK & Europe, North America and Asia. Leading venture capital and growth funds, private equity, and high-growth tech companies rely upon his unsurpassed industry knowledge as much as his relentless commitment to their business. LondonĪs Europe's premier tech business advisors, Shawn and his team have overseen several hundred venture financings, private equity buyouts and M&A transactions over the course of the last decade. Marsha has been recognized in Super Lawyers Rising Stars (2016–2020). Prior to joining Orrick, Marsha was at Kirkland & Ellis LLP and Cahill & Gordon LLP. Marsha’s broad transactional practice includes advising clients on complex securities and financing transactions, including initial public offerings, follow-on offerings and other equity offerings, high yield and investment-grade notes offerings, tender offers and exchange offers, mergers and acquisitions and de-SPAC transactions, as well as corporate governance and SEC compliance and disclosure matters.

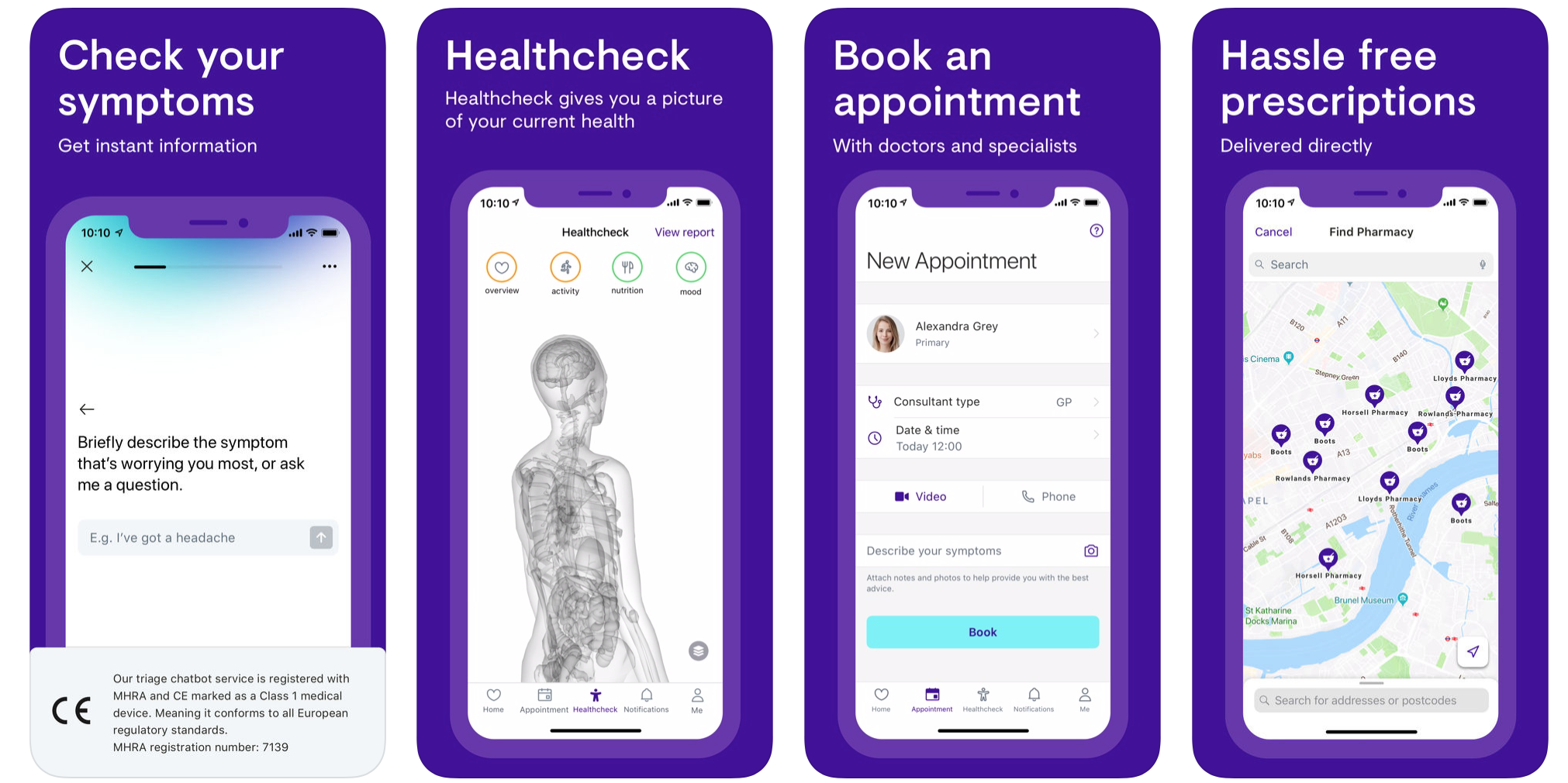

She is a strategic advisor to sponsors, companies and underwriters in a wide range of public and private capital markets transactions, mergers and acquisitions, and securities disclosure and corporate governance matters. Marsha Mogilevich is a Partner in the New York office and a member of Orrick’s Capital Markets group. Babylon, a digital healthcare company, completed its business combination with Alkuri Global Acquisition Corp., a special purpose acquisition company, and began trading on the New York Stock Exchange on October 22 under the new ticker symbols “BBLN” and “BBLN.W”, respectively. Orrick advised VNV Global and Kinnevik in their investments in Babylon's $4.2 billion de-SPAC transaction. Orrick Advises VNV Global & Kinnevik on Babylon Health De-SPAC

0 kommentar(er)

0 kommentar(er)